Bitcoin Q4 Outlook: Will the October Rally Continue?

Bitcoin Extends Three-Quarter Winning Streak

Bitcoin printed a 6.4% gain in Q3, capping a three-quarter uptrend. BTCUSD has climbed 7% since the beginning of October.

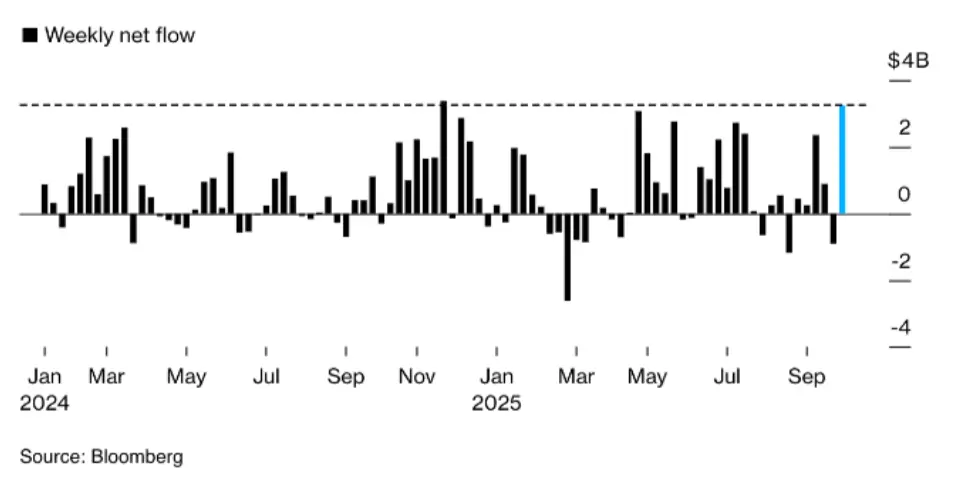

The token has been drawing support from inflows into ETFs and safe-haven demand amid the US government shutdown, according to Bloomberg analysts.

ETF Inflows and Safe-Haven Demand Boost BTC

Bitcoin ETFs saw a USD 3.2 bn inflow from September 29 to October 5. Interestingly, historical data reveals that Bitcoin typically exhibits stellar performance in October:

-

up 11% in October 2024

-

up 29% in October 2023

-

up 6% in October 2022 (a notable gain amid predominantly bearish sentiment throughout the year)

-

up 40% in October 2021

October 2025 may also be a repeat performance, but the wildcard is the end-of-month BTC price target.

Technical Outlook: Bulls vs. Bears at $121.5K

From the standpoint of technical analysis, the 1-month chart shows BTCUSD still trading around $121.5K.

The price action punched through this level but has yet to break above and hold at higher levels.

Consequently, there are two possible scenarios.

Under the best-case scenario, BTCUSD will breach $121.5K to the upside, with the bulls securing a foothold above this mark.

Then one of the driving impulse waves (3rd or 5th) will remain incomplete, opening the door to a longer-term target at levels above $142K.

This scenario was outlined in more detail in an overview written in early August.

Under the worst-case scenario, the bears will achieve a pullback from $121.5K, implying the end of the current trend impulse and reversal into a correction, which could be quite steep.

As part of this corrective move, there could be several plausible options to consider if and when this scenario materializes.

Overall, the Bitcoin market setup was nearly unchanged from late Q3 to early Q4.